English

Search

2025/04/10

February 1, 2025:Trump signed an executive order to impose a 10% tariff on Chinese goods and a 25% tariff on Canadian and Mexican goods, with the tax rate on photovoltaic products rising to as high as 70%.

March 4, 2025:China doubled its tariffs to 20%, and the United States simultaneously threatened to impose "reciprocal tariffs" on the world, causing market panic.

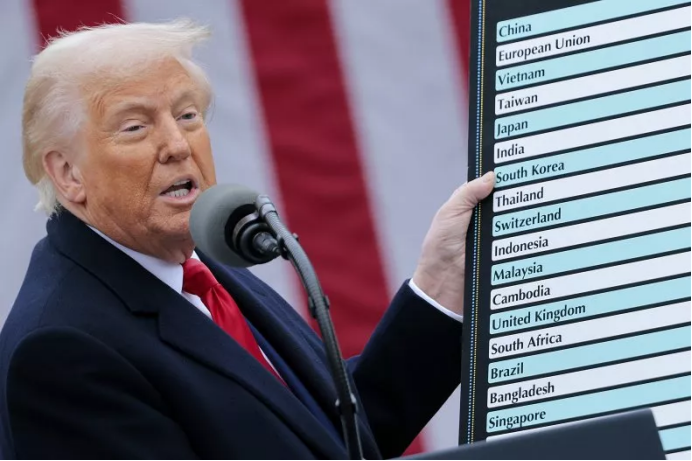

April 2, 2025:The impact of "Liberation Day" on global trade.——Trump signed an executive order to impose a uniform tariff of about 20% on most imported goods and threatened to impose higher tariffs on non-cooperative countries.Among them, tariffs on the EU increased by 20%, tariffs on Vietnam increased by 46%, tariffs on Japan increased by 24%, tariffs on Taiwan increased by 32%, tariffs on the UK increased by 10%, tariffs on Australia increased by 10%, and tariffs on China increased by 34%.

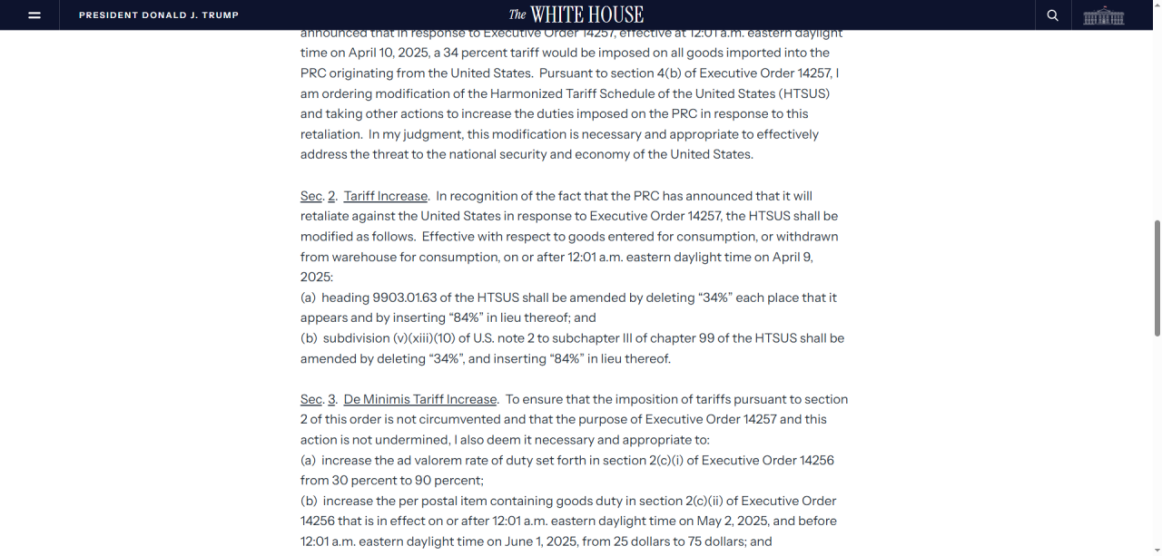

April 9, 2025:China has not withdrawn its countermeasures, and the US has implemented an additional 50% tariff on China. The total amount of US tariffs on China will increase from 54% to a staggering 104%.

Here is the policy link: https://www.thetimes.com/us/news-today/article/trump-tariffs-latest-news-announce-liberation-day-live-j3lftc33n

1. Impact on Traditional Transportation (CIF/FOB/C&F/DDU)

Procurement costs from China will now double or even more.

For example:

- A $10 product now incurs a $10.4 U.S. tariff

- Effectively making your purchase cost over $20 (2x+)

Consider a container of furniture or blankets:

- Original goods value: $30,000

- New tariff payment: $40,000

- Total cost jumps from $30K to $70K (133% increase)

2. Impact on Traditional Transportation (DDP Shipping)

This will increase the duty cost by approximately $0.6/kg. This is compared to the period before Trump took office.

For example:

Generally speaking, our cartons will not exceed 25kg (chargeable weight), otherwise there will be problems in the entire transportation process, including Amazon receiving the cartons.

If we can pack 20 units per carton, with each carton weighing 25kg. The duty part increase about 25kg * $0.6/kg = $15, cost per unit increased by $0.75.But this is the worst case scenario, because normally our cartons don't reach 25kg. So the cost will be less.

But as I emphasized before, this is only the duty part.

If we consider the cost factors of the entire DDP transportation, in my opinion:

1.Ocean Shipping Company will definitely reduce prices, bcz demand will decrease, and there is excess capacity on the Pacific route

2.Chinese suppliers will definitely reduce prices because there are fewer buyers and the market has become fierce.

Therefore, TranBay estimate the overall impact on seller who use DDP shipping to be around $0.4~$0.5/unit. (Compared to the Biden period)

Trump administration imposed tariffs on all countries, including Vietnam, Philippines, and Mexico, I believe relocating factories elsewhere would be inadvisable. The primary reasons are:

1.Incomplete Supply Chains: Other countries lack comprehensive supply networks. If you assemble products there, you may still need to import raw materials from third countries.

2.Workforce Limitations: Labor quality varies significantly. Many countries don't match China's technical proficiency and educational standards—China remains the world's factory.

As for competitors (especially large Amazon sellers) considering U.S. manufacturing, there are critical drawbacks:

1.Prohibitive Labor Costs: U.S. wages are extremely high, with additional constraints from unions and social factors.

2.Supply Chain Rebuilding Unfeasible: Recreating supply chains stateside would take prohibitively long. Moreover, due to high tariffs, few countries would export raw materials to the U.S., which lacks China’s end-to-end production capabilities.

For e-commerce sellers, maintaining a China manufacturing + DDP shipping strategy will secure a powerful supply chain advantage on Amazon or other platforms. This approach delivers 30-40% cost savings versus competitors while providing a 12-month head start over those struggling to relocate their supply chains.